So, promising investments are exactly your fit? Then PRISMA Investment has the right design for you.

MUTUAL FUNDS

PRISMA AKTIV UI

Precisely to your taste:

Asset preservation and target return.

PRISMA Aktiv UI is an asset management mixed fund with the investment focused on Europe and Asia. The target is an annual return of ≥ 4%. Our allocation is as a rule composed of 50% fixed income and a maximum of 50% equities.

You profit from an attractive distribution return, which is achieved through the combination of high-interest European corporate bonds, selected Asian stocks and Asian bonds, dispensing with derivatives or structured financial products. This is an investment policy that has gained the trust of Software AG-Stiftung, which is one of Germany's largest foundations. Trusting an investment here will thus place you in excellent company.

Distribution notice

Shareholders are hereby informed that income appropriations were decided on for PRISMA Aktiv UI for the financial year ending 31 January 2025. The following distributions were effected for the following share classes of PRISMA Aktiv UI as at ex-date 17 March 2025 with value- date at 18 March 2025:

|

Share class I, WKN A1W9A8, |

EUR 2,30 per unit |

|

Share class R, WKN A1W9A7, |

EUR 2,00 per unit |

| Share class S, WKN A2H7NP, | EUR 3,30 per unit |

Share class

SHARE CLASS I

Institutional

Base data

| WKN | A1W9A8 (min. 250.000 €) |

| ISIN | DE000A1W9A85 |

| Distribution approval | DE |

| Fund category | Balanced mixed fund |

| Utilization of Income | distributing |

| Launch Date (Fund) | 03.02.2014 |

| End of Financial Year | 31.01. |

| Fund Volume | 397,6 m € (as of Dec 31, 2025) |

| Share Class | 337,9 m € (as of Dec 31, 2025) |

| Currency Fund | EUR |

| Capital management company | Universal-Investment-Ges. mbH |

| Custodian | State Street Bank |

Downloads & informations

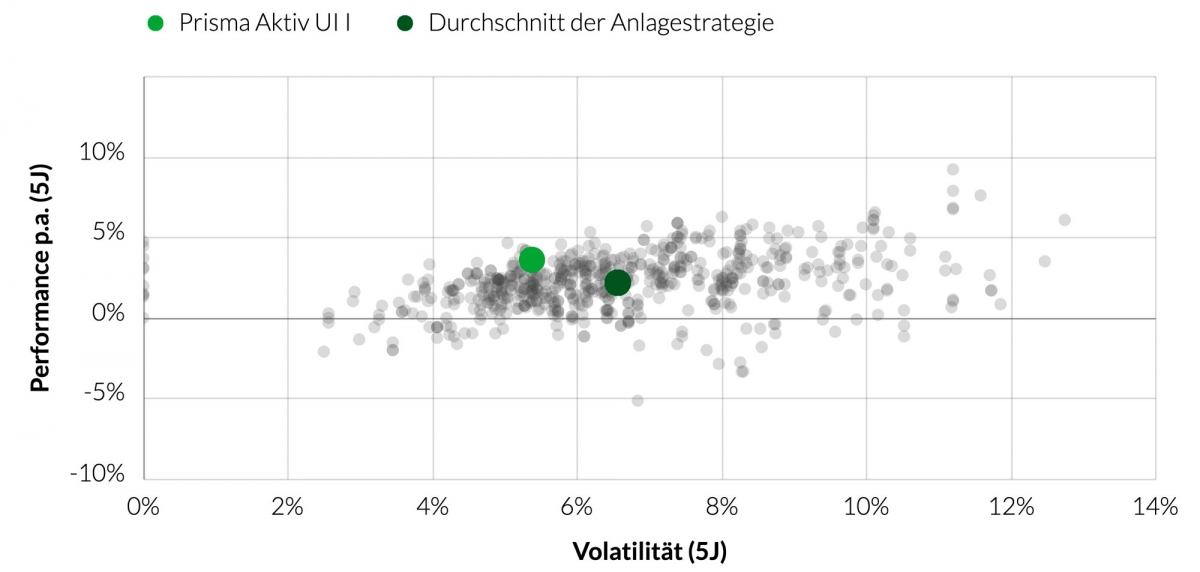

5-year view

Risk-return matrix

Source: Asset Standard / assetstandard.com

"PRISMA Aktiv UI is our absolute core product. Every private customer can, as a shareholder, participate in the accumulated know-how of PRISMA Investment."

Bernd Bötsch, Portfolio Manager and managing partner of

PRISMA Investment GmbH

SHARE CLASS

SHARE CLASS R

Retail

Base data

| WKN | A1W9A7 |

| ISIN | DE000A1W9A77 |

| Distribution approval | DE |

| Fund category | Balanced mixed fund |

| Utilization of Income | distributing |

| Launch Date (Fund) | 03.02.2014 |

| End of Financial Year | 31.01. |

| Fund Volume | 397,6 m € (as of Dec 31, 2025) |

| Share Class | 43,2 m € (as of Dec 31, 2025) |

| Currency Fund | EUR |

| Capital management company | Universal-Investment-Ges. mbH |

| Custodian | State Street Bank |

"Bonds are a pillar of a balanced portfolio. They deliver stability, diversification and, when skilfully selected, attractive returns as well.“

Jochen Rothenbacher, Director Portfolio Management Bonds for

PRISMA Investment GmbH

SHARE CLASS

SHARE CLASS S

Tax-exempt institutions

Base data

| WKN | A2H7NP (min. 50.000 €) |

| ISIN | DE000A2H7NP1 |

| Distribution approval | DE |

| Fund category | Balanced mixed fund |

| Utilization of Income | distributing |

| Launch Date (Fund) | 01.03.2018 |

| End of Financial Year | 31.01. |

| Fund Volume | 397,6 m € (as of Dec 31, 2025) |

| Share Class | 16,6 m € (as of Dec 31, 2025) |

| Currency Fund | EUR |

| Capital management company | Universal-Investment-Ges. mbH |

| Custodian | State Street Bank |

Downloads & informations