Doesn't just sound like a good idea – it really is one.

Our investment approach

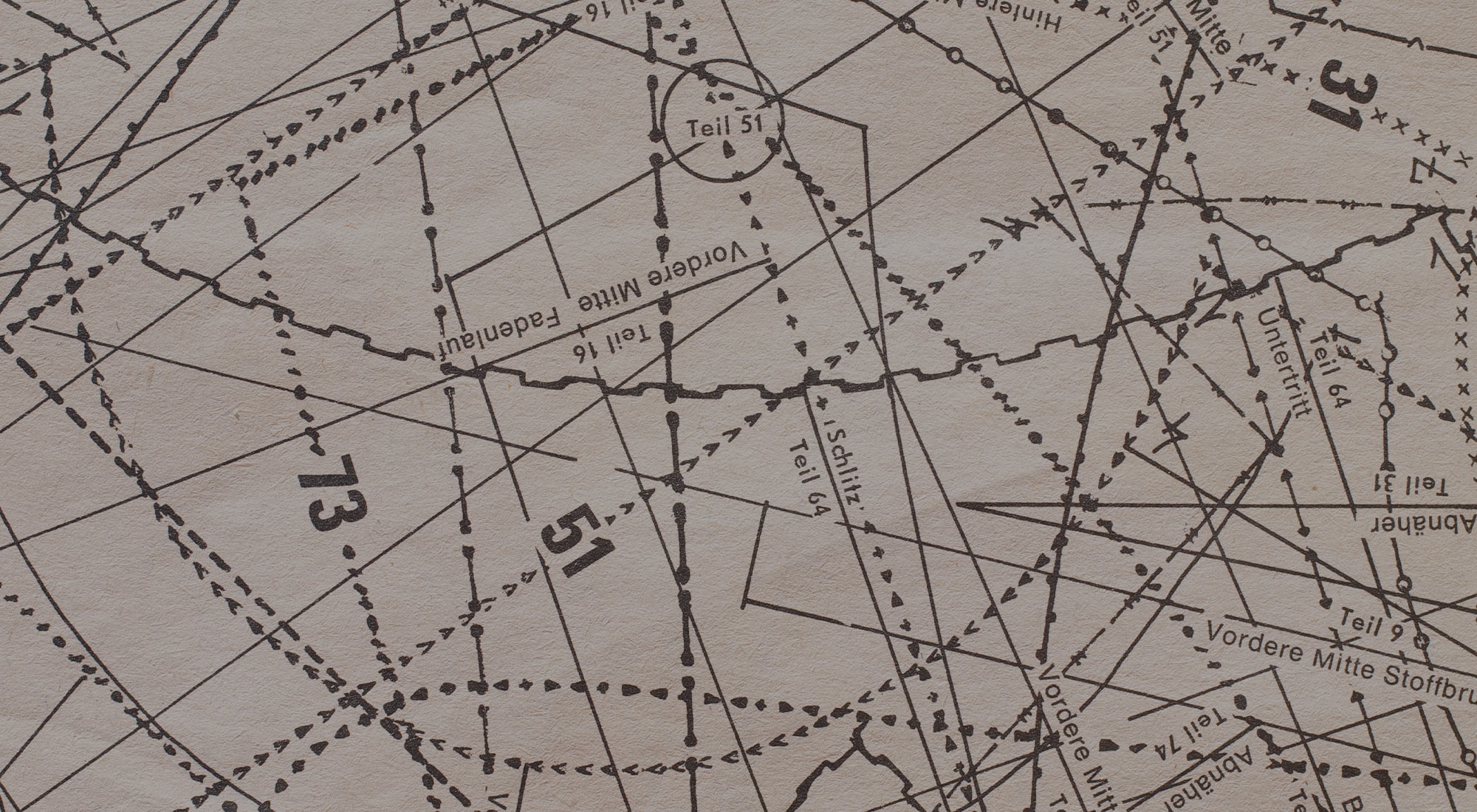

MASTERLY SKILL

AND THE CREATIVITY OF A DESIGNER.

All this for your investment.

An investment off the shelf is what you won't find at PRISMA. Instead we invest actively in business models in the real economy and work out our very own investment style.

For many years now our success has been due to the conscientious selection of our investment objects. The resulting tailor-made PRISMA investment policy rests on a meticulous selection of individual stocks, which is itself based on a thorough, high-quality analysis of business models.

We thus have a "pattern" for establishing, in close relation to the real economy, the intrinsic value of securities and the risk profile attached to corporate bonds. This means that we participate in the value enhancement of the companies we select.

-

Principle of "capital preservation"+ target return

Our investment principle is the preservation of asset value and the achievement of an attractive target return.

-

Active management

Our fund management directs the fund allocation or investment rate – flexibly and independently of benchmarks.

-

Active, benchmark-independent portfolio management

In the process of asset allocation the various sources of returns are weighed up against each other. Asset allocations and the selection of individual stocks are subjected to continuous monitoring.

-

Risk management

One of the central elements of our risk management system is the High-Watermark stop-price procedure for equities.

"Driven by digitalisation, the corporate landscape worldwide is in a state of upheaval on a scale and at a pace that is unprecedented. It is all the more important for us, as an investor, to maintain close contact with the real economy so as to identify the winners in this race in good time."

Bernd Bötsch, Portfolio Manager and managing partner of

PRISMA Investment GmbH